maine excise tax credit

You must always come to Town Hall first to. If line 9 less line 10 is a credit amount enter the amount to the right.

Form Pta200 Download Printable Pdf Or Fill Online Assessors Certification Of Assessment And Municipal Tax Assessment Warrant Maine Templateroller

The excise tax is payable to the Town of Eliot Maine and can be paid at.

. First year 2400 per 1000 of MSRP. The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land. August 5 - Belfast Registration.

Anytime during our business hours. Maine taxpayers now have the option to pay various tax payments online quickly and easily. Fifth year 650 per 1000 of MSRP.

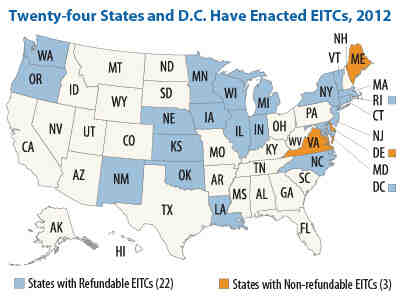

240 13 is further amended to read. Narratives IFTAIRP Refund Programs. Maine Earned Income Credit EIC For tax years beginning in 2021 the Maine EIC is equal to 20 of the federal earned income tax credit.

When it comes down to Maines sales tax on cars youre only taxed on the 5000 credit not the 13000 you bought it for. The law provides that excise tax declines over the first six years of the vehicles life and is calculated as follows. 36 MRSA 1482 sub-5 as amended by PL 2011 c.

An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident or totally junked or abandoned in the same registration year is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward. Or rather you would include it along with your other sales taxes paid in lieu of the alternative choice of taking a deduction for state sales taxes paid. As required by the Constitution of Maine article IV part third 23 the Legislature must reimburse each municipality at least 50 of the property tax revenue loss suffered by that municipality during the previous calendar year as a result of statutory property tax exemptions or credits enacted after April 1 1978.

Environmental Fees Ground Water Tax - offsite. Our office is also staffed to administer and oversee the property tax administration in the unorganized territory. Tax payments for these tax types can be made now via the Maine Tax Portal MTP at.

As of August 2014 mil rates are as follows. Line 9 less line 10. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to excise tax.

Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. The bureau shall grant to the wholesale licensee a credit of all state excise tax paid in connection with that sale under the following conditions.

Excise Tax is an annual tax that must be paid prior to registering a vehicle. When a vehicle needs to be registered an excise tax is collected prior to the registration. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident or totally junked or abandoned in the same registration year is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle.

Credit Carry Forward From Prior Period. Second year 1750 per 1000 of MSRP. Cannabis Excise Tax.

18 rows Commercial Forestry Excise Tax. Blueberry Potato Mahogany Quahog and Railroad Excise Taxes. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

WHAT IS EXCISE TAX. 1 The bureau shall grant a credit for the excise tax on malt liquor or wine sold by wholesale licensees to any instrumentality of the United States or any Maine National Guard state training site exempted by the bureau. Mil rate is the rate used to calculate excise tax.

Third year 1350 per 1000 of MSRP. YEAR 1 0240 mil rate YEAR 2 0175 mil rate YEAR 3 0135 mil rate YEAR 4 0100 mil rate YEAR 5 0065 mil rate YEAR 6. Be it enacted by the People of the State of Maine as follows.

Excise Tax Credit Summary Report Rev. Property Tax Educational Programs. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

Use line 12 if the result is a credit amount. In this case the total selling price of your vehicle comes out to 8000. Excise tax is an annual local town tax paid at the Town Hall where the the vehicle resides for over six 6 months of the year.

How much is the excise tax. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident or totally junked or. Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Individual income tax credits provide a partial refund of property tax andor rent paid during the tax. The Maine EIC is available to Maine individual income tax taxpayers who properly claim the federal earned income tax credit on federal Form 1040 or Form 1040-SR or who are otherwise eligible to claim the federal credit except that they filed a federal individual income tax return using an IRS-issued Individual Taxpayer Identification Number ITIN or had no qualifying.

The purpose of the tax is to partially offset the costs of forest fire protection expenditures of the Department of Agriculture Forestry and Conservation. Fourth year 1000 per 1000 of MSRP. If you wish a refund rather than a carry forward to the next period check here.

The credit shall be allowed in any place in which the excise tax is payable. Any owner who has paid the excise tax for a watercraft which is transferred in the same tax year is entitled to a credit to the maximum amount of the tax previously paid in that year for any number of watercraft regardless of the number of transfers which may be required of him in the same tax year. In Maine you may deduct the sales taxes paid on the purchase of a new vehicle.

Excise tax is paid at the local town office where the owner of the vehicle resides. 2721 - 2726. The Maine EIC is available to Maine individual income tax taxpayers who properly claim the federal earned income tax credit on federal Form 1040 or Form 1040-SR or who are otherwise eligible to claim the federal credit except that they filed a federal individual income tax return using an IRS-issued Individual.

An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward the tax for any number of vehicles regardless of the number of transfers that may be required of the owner or lessee in that registration year. Fall 2022 Certified Maine Assessor CMA Exams. Visit the Maine Revenue Service page for updated mil rates.

Where do I pay the excise tax. Taxpayers who filed a federal income tax return using a federal individual taxpayer identification number ITIN issued by the Internal Revenue Service or who are 18 to 24 years of age and have no qualifying children and are otherwise qualified for. Maine Property Tax School Belfast August 1-5 2022 Registration.

Welcome to Maine Revenue Services EZ Pay.

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

State Corporate Income Tax Rates And Brackets Tax Foundation

Maine Llc Formation Checklist Checklist For Starting An Llc Truic

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

State Corporate Income Tax Rates And Brackets Tax Foundation

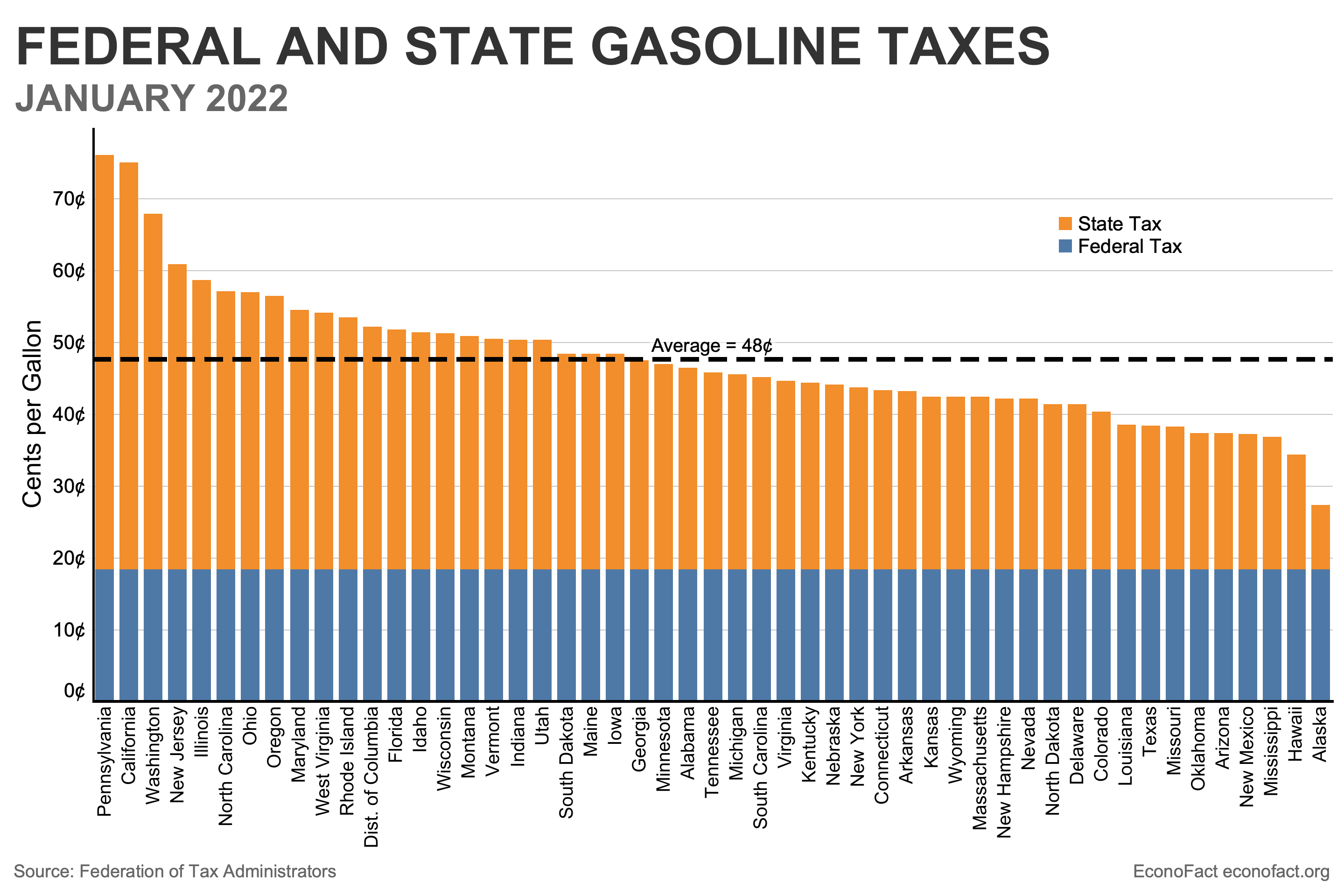

Fuel Tax Relief States Take Action Tip Excise Tax Recovery Services

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

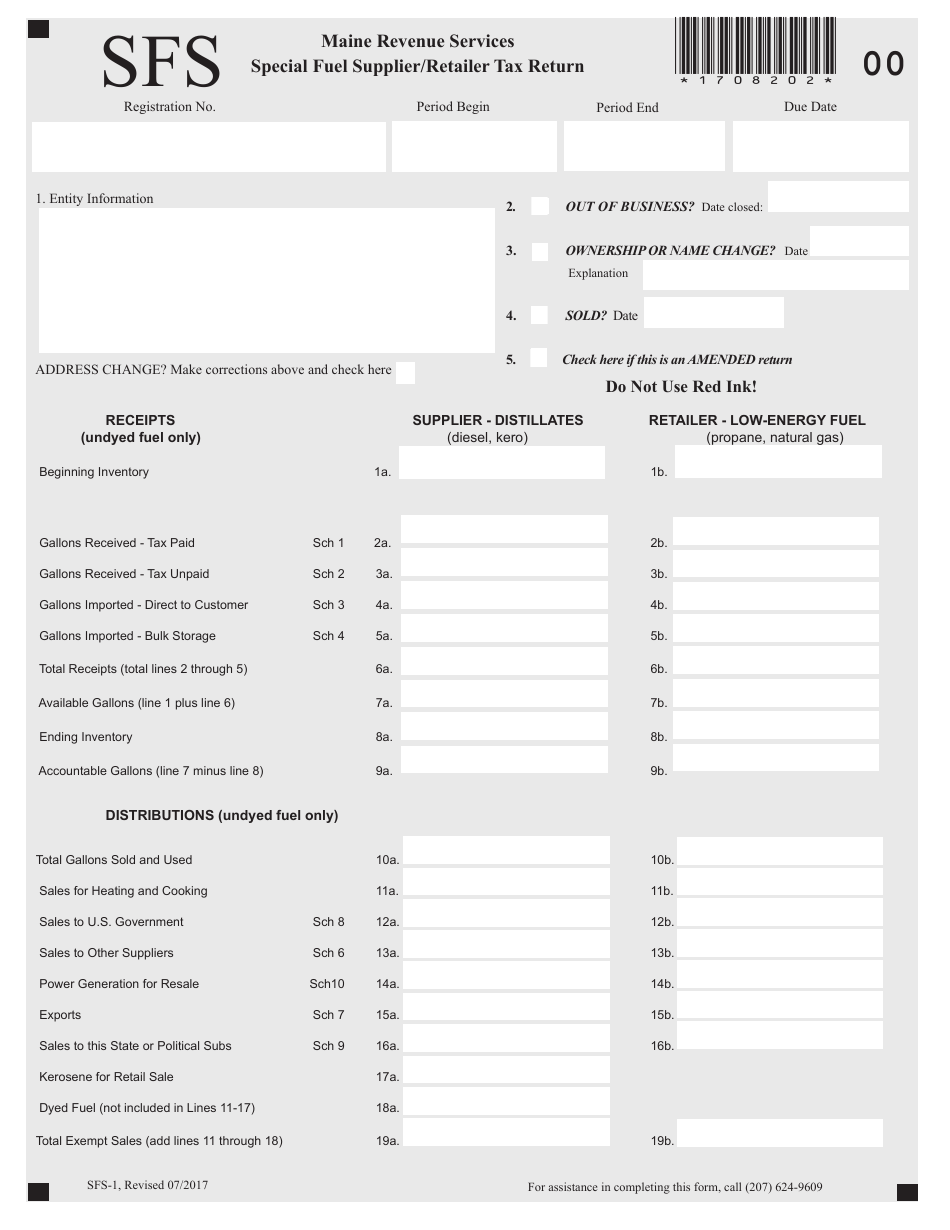

Form Sfs 1 Download Fillable Pdf Or Fill Online Special Fuel Supplier Retailer Tax Return Maine Templateroller

Corporate Taxes By State Where Should You Start A Business Hourly Inc

The Compelling Data And Moral Case For Continuing The Child Tax Credit Expansion Itep

Form Sfs 1 Download Fillable Pdf Or Fill Online Special Fuel Supplier Retailer Tax Return Maine Templateroller

Biodiesel Fuel Credit Excise Tax Andretaxco Pllc

Medical Cannabis Legislation Advances In Maine Legislature Cannabis Business Times

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation